Legislation

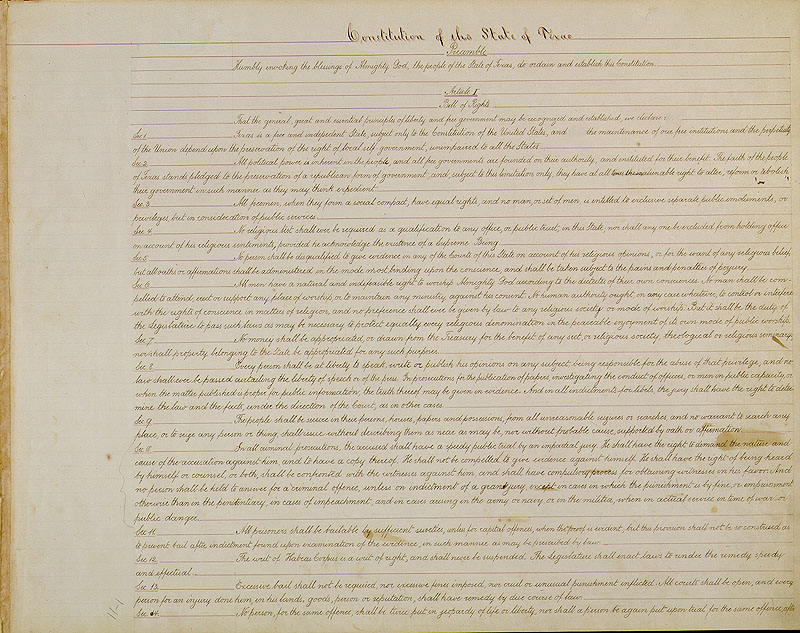

Texas Constitution

Download a pdf of the Official Texas Constitution.

The official documents page for the Texas Constitution can be found HERE. That page can also be used to search Texas Statutes. If you would like to download a pdf of the Texas Constitution, click on the link below.

Of Particular note to Texit, as well as to the Executive Orders issued by Govenor Abbott, are the following sections.

Article 1 is the Bill of Rights. The sections below are copied in their entirety.

- Article 1 – Section 1 : FREEDOM AND SOVEREIGNTY OF STATE. Texas is a free and independent State, subject only to the Constitution of the United States, and the maintenance of our free institutions and the perpetuity of the Union depend upon the preservation of the right of local self-government, unimpaired to all the States.

- Article 1 – Section 2: INHERENT POLITICAL POWER; REPUBLICAN FORM OF GOVERNMENT. All political power is inherent in the people, and all free governments are founded on their authority, and instituted for their benefit. The faith of the people of Texas stands pledged to the preservation of a republican form of government, and, subject to this limitation only, they have at all times the inalienable right to alter, reform or abolish their government in such manner as they may think expedient.

- Article 1 – Section 8: FREEDOM OF SPEECH AND PRESS; LIBEL. Every person shall be at liberty to speak, write or publish his opinions on any subject, being responsible for the abuse of that privilege; and no law shall ever be passed curtailing the liberty of speech or of the press. In prosecutions for the publication of papers, investigating the conduct of officers, or men in public capacity, or when the matter published is proper for public information, the truth thereof may be given in evidence. And in all indictments for libels, the jury shall have the right to determine the law and the facts, under the direction of the court, as in other cases.

- Article 1 – Section 19: DEPRIVATION OF LIFE, LIBERTY, PROPERTY, ETC. BY DUE COURSE OF LAW. No citizen of this State shall be deprived of life, liberty, property, privileges or immunities, or in any manner disfranchised, except by the due course of the law of the land.

- Article 1 – Section 27: RIGHT OF ASSEMBLY; PETITION FOR REDRESS OF GRIEVANCES. The citizens shall have the right, in a peaceable manner, to assemble together for their common good; and apply to those invested with the powers of government for redress of grievances or other purposes, by petition, address or remonstrance.

- Article 1 – Section 28: SUSPENSION OF LAWS. No power of suspending laws in this State shall be exercised except by the Legislature.

- Article 1 – Section 29: BILL OF RIGHTS EXCEPTED FROM POWERS OF GOVERNMENT AND INVIOLATE. To guard against transgressions of the high powers herein delegated, we declare that everything in this “Bill of Rights” is excepted out of the general powers of government, and shall forever remain inviolate, and all laws contrary thereto, or to the following provisions, shall be void.

Article 17 – Section 1 – PROPOSED AMENDMENTS; PUBLICATION; SUBMISSION TO VOTERS; ADOPTION.

- (a) The Legislature, at any regular session, or at any special session when the matter is included within the purposes for which the session is convened, may propose amendments revising the Constitution, to be voted upon by the qualified voters for statewide offices and propositions, as defined in the Constitution and statutes of this State. The date of the elections shall be specified by the Legislature. The proposal for submission must be approved by a vote of two-thirds of all the members elected to each House, entered by yeas and nays on the journals.

- (b) A brief explanatory statement of the nature of a proposed amendment, together with the date of the election and the wording of the proposition as it is to appear on the ballot, shall be published twice in each newspaper in the State which meets requirements set by the Legislature for the publication of official notices of offices and departments of the state government. The explanatory statement shall be prepared by the Secretary of State and shall be approved by the Attorney General. The Secretary of State shall send a full and complete copy of the proposed amendment or amendments to each county clerk who shall post the same in a public place in the courthouse at least 30 days prior to the election on said amendment. The first notice shall be published not more than 60 days nor less than 50 days before the date of the election, and the second notice shall be published on the same day in the succeeding week. The Legislature shall fix the standards for the rate of charge for the publication, which may not be higher than the newspaper’s published national rate for advertising per column inch.

- (c) The election shall be held in accordance with procedures prescribed by the Legislature, and the returning officer in each county shall make returns to the Secretary of State of the number of legal votes cast at the election for and against each amendment. If it appears from the returns that a majority of the votes cast have been cast in favor of an amendment, it shall become a part of this Constitution, and proclamation thereof shall be made by the Governor.

Election

Texans to Vote on 17 Constitutional Amendments, with Historic Homestead Exemption in Spotlight

AUSTIN, TX — On November 4, Texas voters will face a marathon ballot featuring 17 proposed amendments to the state’s constitution, a document that has seen over 500 revisions since 1876. Secretary of State Jane Nelson, who oversaw the ballot order draw, urged Texans to seize this chance to “make your voice heard about the governing document of our state.” From tax relief to judicial reform, these propositions reflect a conservative vision of limited government, economic liberty, and state sovereignty. But one measure, Proposition 13, stands out as a landmark effort to deliver substantial property tax relief to homeowners—a cornerstone issue for Texans grappling with rising costs in a state without an income tax.

Proposition 13: A Game-Changer for Homeowners

At the heart of this constitutional lineup is Proposition 13 (SJR 2), which would raise the homestead exemption for school district property taxes from $100,000 to $140,000, with an even higher $150,000 exemption for seniors and disabled homeowners. Paired with a tax rate compression in Senate Bill 1, this measure promises an average savings of $496.57 for homeowners, according to Sen. Paul Bettencourt (R-Houston), the bill’s author. In a unanimous vote, the Texas Senate signaled its commitment to easing the property tax burden, a perennial concern for Texans facing skyrocketing appraisals.

For many, Proposition 13 is a lifeline. Bettencourt noted that 80 to 90% of Texas seniors could pay zero school district property taxes under this plan, as would average homeowners in 49% of Texas school districts where home values fall below $140,000. This is no small feat in a state where property taxes fund much of public education. To address concerns about local revenue losses, Bettencourt emphasized that the state would reimburse school districts, ensuring they remain fully funded. “Today, the Texas Senate delivered a win for homeowners statewide,” he declared, framing the measure as a victory for taxpayers without sacrificing educational quality.

Yet, some lawmakers raised red flags during Senate debates, warning that local taxing entities—cities, counties, and special districts—might offset these savings by raising their own rates. This tension underscores a broader challenge: balancing tax relief with the fiscal needs of local governments. For constitutional conservatives, Proposition 13 embodies the principle that government should prioritize returning money to citizens, but voters must weigh whether the state’s reimbursement plan can prevent local tax hikes that could erode the promised relief.

A Broader Conservative Agenda

While Proposition 13 takes center stage, the remaining 16 amendments advance a robust conservative agenda. Proposition 2 (SJR 18) bans taxes on capital gains—realized or unrealized—protecting wealth creation from state overreach. Proposition 6 (HJR 4) shields securities transactions from occupational or transactional taxes, bolstering financial markets. Proposition 8 (HJR 2) prohibits death taxes on estates or inheritances, ensuring families keep more of their legacy.

Other tax relief measures include Proposition 5 (HJR 99), exempting animal feed held for retail from ad valorem taxes, and Proposition 9 (HJR 1), which extends similar exemptions to income-producing personal property. Proposition 7 (HJR 133) offers tax breaks for surviving spouses of veterans with presumed service-connected conditions, while Proposition 10 (SJR 84) provides temporary exemptions for homestead improvements destroyed by fire. Proposition 11 (SJR 85) further boosts exemptions for elderly and disabled homeowners, complementing Proposition 13’s focus on homestead relief.

Infrastructure and education also feature prominently. Proposition 1 (SJR 59) creates a permanent fund for the Texas State Technical College System, supporting trade programs vital to Texas’ economy. Proposition 4 (HJR 7) dedicates sales tax revenue to the Texas Water Fund, addressing water scarcity in a growing state. Proposition 14 (SJR 3) establishes a $3 billion Dementia Prevention and Research Institute, though its hefty price tag raises questions about fiscal priorities.

Safety, Sovereignty, and Civic Values

Public safety and border security are addressed in Proposition 3 (SJR 5), which mandates bail denial for certain felony offenses, and Proposition 17 (HJR 34), which offers tax exemptions for border security infrastructure in counties along the U.S.-Mexico border. Both align with conservative priorities of law and order and state sovereignty, though the latter’s vague definition of “infrastructure” warrants scrutiny.

Cultural and civic concerns shine through in Proposition 15 (SJR 34), affirming parents as the primary decision-makers for their children—a rebuke to institutional overreach in schools and healthcare. Proposition 16 (SJR 37) clarifies that only U.S. citizens may vote, reinforcing election integrity amid national debates. Proposition 12 (SJR 27) reforms the State Commission on Judicial Conduct, enhancing accountability for judicial misconduct, a move conservatives will welcome as a check on judicial power.

With early voting from October 20-31 and a registration deadline of October 6, Texans must act swiftly to study these amendments. Detailed information is available at VoteTexas.gov. Proposition 13, with its promise of historic tax relief, may dominate headlines, but the full slate demands careful consideration. Each amendment shapes the delicate balance between individual liberty and public needs, a balance constitutional conservatives hold dear.

As Texas voters head to the polls, they carry the weight of self-governance. In a state fiercely proud of its independence, this election is a chance to reaffirm principles of limited government and personal freedom—nowhere more so than in Proposition 13, which could redefine the financial burdens of homeownership for millions. The question is whether Texans will embrace this vision or demand greater clarity on its long-term impacts.

Featured

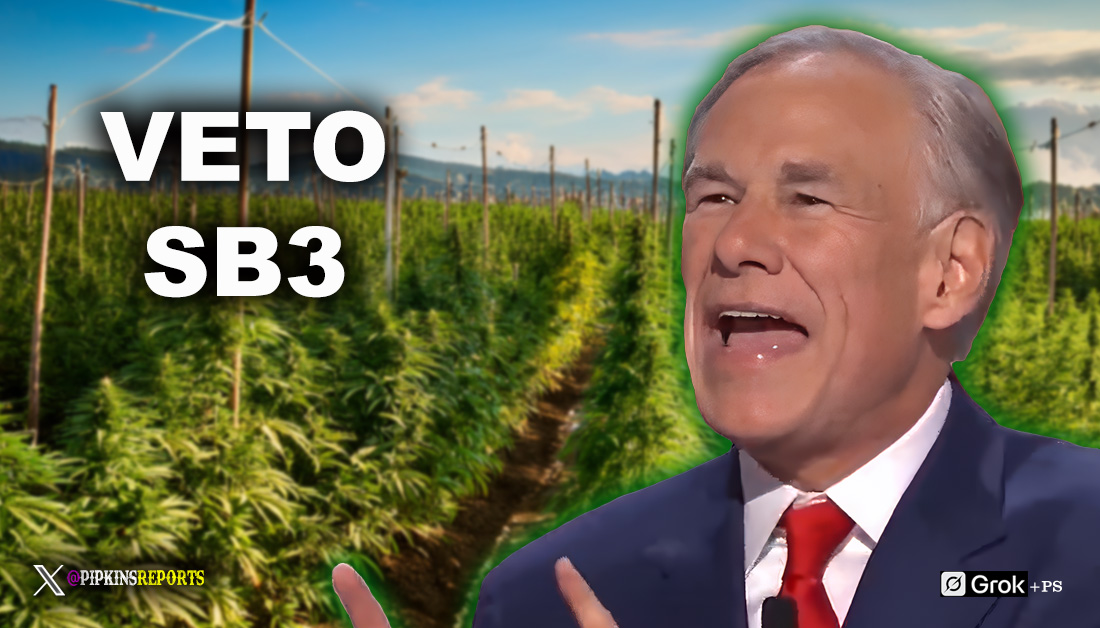

Abbott’s Veto of SB3 Saves Texas Hemp Industry, Sparks Battle Over Regulation

In a dramatic eleventh-hour move, Texas Governor Greg Abbott vetoed Senate Bill 3 (SB3) late Sunday night, June 22, 2025, sparing the state’s $8 billion hemp industry from obliteration and setting the stage for a contentious special legislative session to address the regulation of consumable hemp products. The decision, which defied the expectations of powerful allies like Lieutenant Governor Dan Patrick, has ignited a firestorm of debate, pitting free-market principles and constitutional fidelity against calls for stringent public safety measures. For Texas conservatives, Abbott’s veto represents a principled stand against heavy-handed government overreach, but it also exposes fault lines within the Republican coalition as the state grapples with the future of a burgeoning industry.

SB3, authored by Senator Charles Perry (R-Lubbock) and championed by Patrick, sought to ban all consumable hemp products containing any measurable amount of tetrahydrocannabinol (THC) or other intoxicating cannabinoids, including the popular delta-8 and delta-9 compounds. The bill’s draconian provisions—criminalizing possession as a misdemeanor and manufacturing as a felony—would have shuttered an industry that employs 53,000 Texans, generates $267 million in annual tax revenue, and supports thousands of small businesses and farmers. Its passage through the Senate (26–5) and House (87–54) reflected strong Republican support, driven by concerns over unregulated hemp products and their accessibility to minors. Yet, the bill’s blanket prohibition clashed with the federal 2018 Farm Bill, which legalizes hemp products with up to 0.3% delta-9 THC, setting the stage for Abbott’s veto.

In a four-page proclamation, Abbott delivered a constitutional rebuke to SB3, arguing that its outright ban would “not withstand valid constitutional challenges” and would create a “collision course” with federal law. Citing a 2023 federal court ruling that halted a similar ban in Arkansas, Abbott warned that SB3 would likely be enjoined, leaving Texas with no regulatory framework to protect public safety. “The result in Arkansas? Their law has sat dormant, meaningless, having no effect for nearly two years,” he wrote. Instead of prohibition, Abbott called for a regulatory approach modeled on alcohol laws, including age restrictions, mandatory testing, and local control over retail. His announcement of a special session starting July 21, 2025, to craft such a framework signals a commitment to balancing public safety with economic liberty—a hallmark of constitutional conservatism.

The veto was a triumph for the Texas Hemp Business Council, which mobilized 150,000 petition signatures and 5,000 handwritten letters to sway the governor. “Governor Abbott’s veto reinforces Texas’ reputation as a leader in business innovation and practical policymaking,” the council declared, praising his rejection of “overreach” that would have pushed consumers toward unregulated black markets. Veterans, a key constituency, also celebrated. Dave Walden, a combat veteran and Texas VFW senior vice commander, credited hemp-derived THC gummies with helping him avoid opioids since 2018. “This is about control, not public safety,” Walden said at a June press conference. “Veterans are caught in the crossfire.”

Farmers and small business owners echoed this sentiment. A sixth-generation Texan farmer warned that SB3 would “wipe out the entire hemp crop,” devastating rural economies. Candice Stinnett, a Texas Hemp Coalition board member, expressed relief, noting the industry’s willingness to embrace “tightened” regulations. On X, the hashtag #VetoSB3 trended as Texans from all walks—entrepreneurs, patients, and liberty-minded conservatives—hailed Abbott’s decision. “Texans aren’t buying it, and neither should @GregAbbott_TX,” posted the Hemp Business Council, reflecting widespread skepticism of prohibitionist rhetoric.

Yet, the veto has drawn sharp criticism from SB3’s supporters, exposing tensions within the GOP. Lieutenant Governor Patrick, visibly stung, accused Abbott of betraying the 105 Republicans who backed the bill, along with law enforcement and families affected by addiction. In a fiery X post, Patrick lamented Abbott’s “total silence” during the legislative session and announced a press conference for June 23 to rally opposition. Groups like Citizens for a Safe and Healthy Texas, backed by Houston-area mothers, argued that unregulated hemp products pose a dire threat to youth, citing cases of mental health crises linked to high-potency THC.

For constitutional conservatives, Abbott’s veto is a victory for limited government and federalism. SB3’s clash with the 2018 Farm Bill risked federal preemption, undermining Texas’ sovereignty to regulate its own markets. Moreover, its criminal penalties—jailing farmers and shop owners for federally legal products—smacked of the same overreach conservatives decry in other contexts. The Reason Foundation, a libertarian voice, had urged Abbott to reject SB3, arguing it would “dismantle” an industry while doing little to curb youth access. Regulation, not prohibition, they argued, is the answer.

Still, the veto is not the end of the story. Abbott’s call for a special session places the hemp issue squarely in the crosshairs of Texas’ political machine. The governor’s proposed regulatory framework—barring sales to minors, mandating testing, and empowering local governments—offers a path forward but faces hurdles. Patrick’s influence in the Senate and the bill’s prior legislative support suggest a fierce fight ahead. The hemp industry, while relieved, remains on edge, with stakeholders like Hayden Meek of Delta 8 Denton preparing for potential legal battles if regulation veers too restrictive.

Abbott’s decision underscores a broader truth: in Texas, the battle for liberty often hinges on resisting the temptation to over-regulate in the name of safety. As the special session looms, conservatives must hold the line, ensuring that any new framework respects the Constitution, protects economic freedom, and avoids the pitfalls of prohibition. For now, the hemp industry breathes a sigh of relief—but the fight for its future is just beginning.

Featured

Corporations Are Not People Act

In a democracy, the voice of the people is paramount, yet the growing influence of corporations threatens to drown out the voices of individual citizens. The proposed “Corporations Are Not People Act” addresses this critical issue by reaffirming that constitutional rights, such as free speech, are intended for living, breathing individuals, not corporate entities. This legislation is essential to safeguard our democratic principles, ensuring that political contributions and lobbying efforts are driven by the will of the people, not by corporate interests.

The core stipulations of this Act are straightforward yet powerful. It unequivocally states that corporations are not protected by the Constitution as living persons, thereby eliminating their claim to free speech rights. Moreover, it prohibits all corporate financial contributions to political campaigns and Political Action Committees (PACs), and bans corporate lobbying efforts aimed at Congress. Instead, only natural persons who are citizens and at least 18 years of age may contribute to political campaigns or PACs, with a maximum contribution limit of $10,000 per election period.

The urgency of this legislation cannot be overstated. Corporate influence in politics has reached unprecedented levels, undermining the democratic process and skewing policy decisions in favor of those with the deepest pockets. By enacting the “Corporations Are Not People Act,” we can restore the integrity of our elections and ensure that elected officials are accountable to their constituents, not corporate donors.

We call on our lawmakers to sponsor and champion this legislation. It is time to reclaim our democracy and reaffirm that it is the people, not corporations, who hold the ultimate power in our nation. This Act is not just a legal necessity but a moral imperative, vital for the health and future of our democratic system. Let us take this crucial step together, ensuring that every citizen’s voice is heard and valued equally in the halls of power.

Corporations Are Not People Act

Title I: General Provisions

Section 101: Short Title

This Act may be cited as the “Corporations Are Not People Act.”

Section 102: Purpose

The purpose of this Act is to clarify the distinction between corporations and natural persons, ensuring that constitutional rights intended for living individuals are not extended to corporations, and to regulate corporate influence in political processes.

Title II: Legal Definitions

Section 201: Definitions

For the purposes of this Act:

- Corporation: Any entity established under the laws of the United States or any state, including but not limited to companies, associations, partnerships, and other similar entities.

- Natural Person: A living, breathing human being.

- Political Campaign: An organized effort to influence the decision-making process within a specific group, particularly regarding the election of candidates to public office.

- Political Action Committee (PAC): An organization that raises money privately to influence elections or legislation, particularly at the federal level.

- Lobbying: Any attempt by individuals or private interest groups to influence the decisions of government, typically in the legislative or executive branches.

Title III: Constitutional Clarifications

Section 301: Corporations as Legal Entities

Corporations are recognized as legal entities but are not natural persons. Therefore, they do not possess constitutional rights afforded to natural persons under the U.S. Constitution.

Section 302: Free Speech Rights

Corporations do not have free speech rights under the First Amendment of the U.S. Constitution. The protections of free speech are reserved for natural persons.

Title IV: Political Contributions and Expenditures

Section 401: Prohibition on Corporate Contributions

Corporations are prohibited from contributing any financial resources, directly or indirectly, to any political campaign, candidate, or Political Action Committee (PAC).

Section 402: Restrictions on Individual Contributions

Only natural persons who are citizens of the United States and 18 years of age or older may contribute to political campaigns or PACs.

- Contributions by individuals shall not exceed $10,000 to any single political candidate or PAC during any election period.

- An election period is defined as the time from the official announcement of a candidate’s campaign until the conclusion of the election.

Section 403: Enforcement and Penalties

- Any corporation found in violation of Section 401 shall be subject to fines equal to twice the amount of the illegal contribution.

- Individuals found in violation of Section 402 shall be subject to fines and potential imprisonment, as determined by the Federal Election Commission (FEC).

Title V: Lobbying Restrictions

Section 501: Prohibition on Corporate Lobbying

Corporations are prohibited from engaging in lobbying activities directed at members of Congress or federal agencies.

Section 502: Individual Lobbying

Lobbying activities are only permitted by natural persons who must register with the appropriate regulatory body and adhere to all disclosure requirements.

Section 503: Enforcement and Penalties

- Corporations found in violation of Section 501 shall be subject to fines and restrictions on future business operations with the federal government.

- Individuals who fail to register or disclose lobbying activities as required under Section 502 shall be subject to fines and potential imprisonment.

Title VI: Implementation and Review

Section 601: Implementation Timeline

This Act shall take effect 180 days after its enactment to allow for necessary adjustments and compliance measures.

Section 602: Review and Report

The Federal Election Commission (FEC) shall review the implementation of this Act and submit a report to Congress within two years of its enactment, including recommendations for any necessary amendments or additional legislation.

Section 603: Severability

If any provision of this Act or its application to any person or circumstance is held invalid, the remainder of the Act, and the application of its provisions to other persons or circumstances, shall not be affected.

Title VII: Miscellaneous Provisions

Section 701: Amendments to Other Laws

Any laws or provisions in conflict with this Act are hereby amended to the extent of the conflict to ensure consistency with the provisions of this Act.

Section 702: Rulemaking Authority

The Federal Election Commission (FEC) shall have the authority to promulgate regulations to implement and enforce the provisions of this Act.

Section 703: Authorization of Appropriations

Such sums as may be necessary are authorized to be appropriated to the Federal Election Commission (FEC) to carry out the provisions of this Act.

This proposed legislative framework seeks to reinforce the distinction between corporations and natural persons, ensuring that constitutional rights and political influence are reserved for living individuals. By restricting corporate contributions and lobbying activities, the “Corporations Are Not People Act” aims to reduce corporate influence in politics and enhance the integrity of the democratic process.

-

Election1 week ago

Election1 week agoAbbott’s Backroom Play: How Greg Abbott Used a Legal Loophole to Install Kelly Hancock as Texas Comptroller Without Senate Confirmation

-

Featured5 days ago

Featured5 days agoAbbott’s Veto of SB3 Saves Texas Hemp Industry, Sparks Battle Over Regulation

-

Election2 days ago

Election2 days agoTexans to Vote on 17 Constitutional Amendments, with Historic Homestead Exemption in Spotlight

You must be logged in to post a comment Login